Independent contractor hourly rate calculator

The minimum pay rate will jump from 2763hour to 3713hour for employers with more than 50 employees in Washington. The tool helps individuals communities and employers determine a local wage rate that allows residents to meet minimum standards of living.

Hourly Rate Calculator The Filmmaker S Production Bible

Aug 31 2022 Must withhold your own taxesEmployers like contractors because they can avoid paying for taxes and benefits meaning those costs fall entirely on independent contractorsIndependent contractors have to pay Social Security and Medicare for both the employer and the employeeAs a business the contractor can deduct certain expenses on this.

. Medicare tax rate is 145 total including employer contribution. Easy to use quick way to create your paycheck stubs. House Cleaning Cost Calculator.

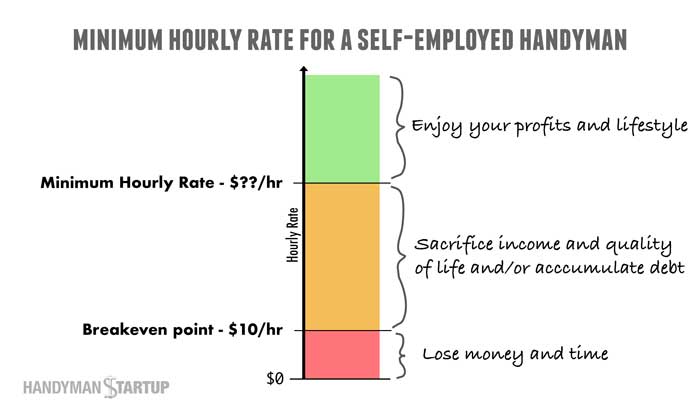

Industry Finder from the Quarterly Census of Employment and Wages. Total Monthly Living Expenses L Total Monthly Business Expenses B Total Billable Hours Per Month H Total Taxes T Your Minimum Hourly Rate LH 1 T BH Example. From what I know 70 to an independent contractor is the most generous I have heard of.

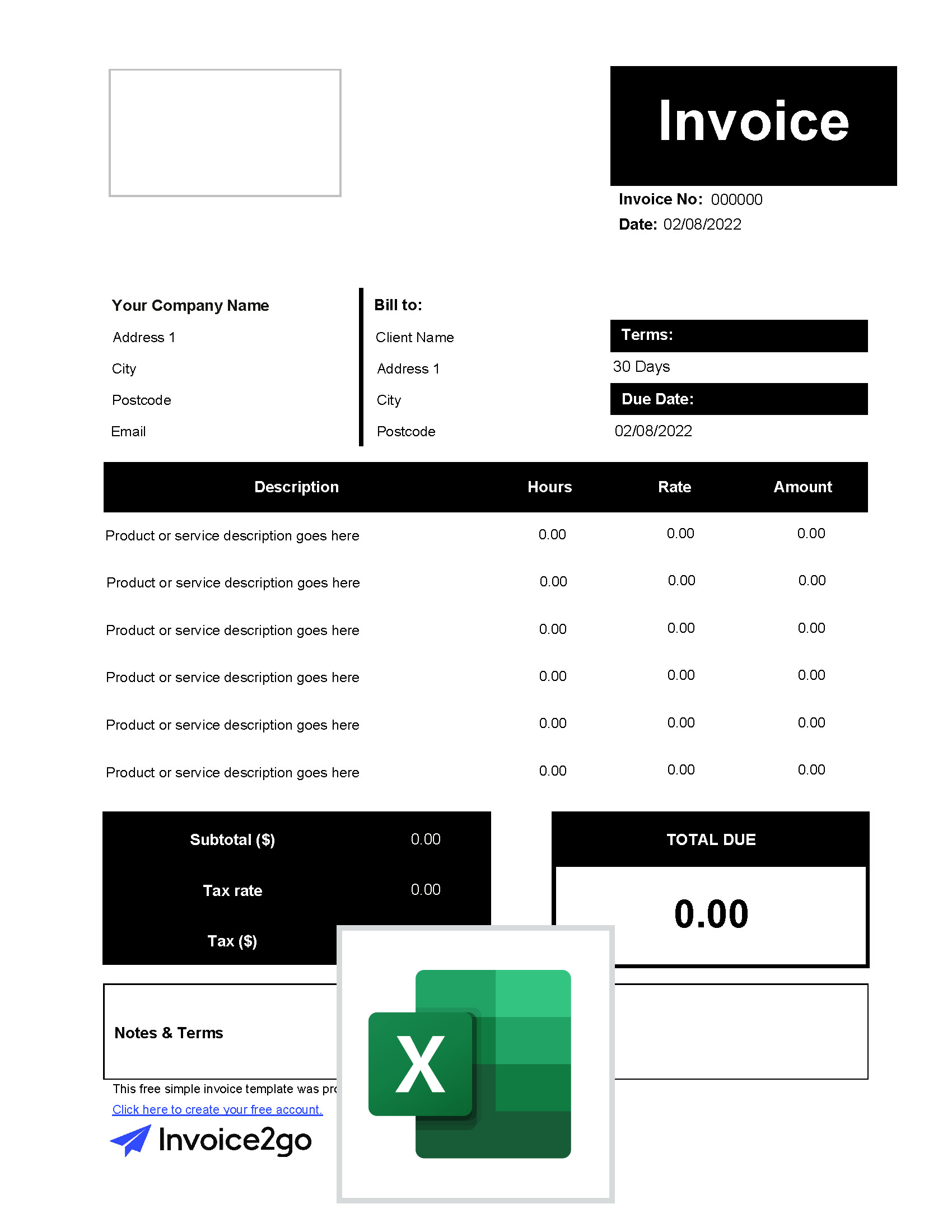

Finally multiply your hourly rate by 8 to reach your day rate. The average national hourly rate for house cleaning services is 25 to 90 per. You can currently generate an Invoice in 5 languages with more coming.

While most general contractors like to use the cost-plus method to charge their customers some will also agree to work for an hourly rate. CPI Inflation Calculator. Simply enter your hours into the quantity field and your hourly rate into the price field and the app will calculate the price for you.

The independent contractors business must be one that will continue to exist after the hiring company has terminated the contract. Before you dive in its always wise to do a little market research to see what others in the industry are charging for their services. You may pay contractors a set amount either hourly or by the project.

Tax rates are dependent on income brackets. The Consumer Price Index for All Urban Consumers was unchanged in July 2022 after rising 13 percent in June and 10 percent in May. Incomes above the threshold amounts will result in an additional 045 total including employer contribution.

Can I create an invoice in another language. Read the full report for national and state-by-state data on volunteer hours. Federal income tax self-employment tax and potentially state income tax.

290 for incomes below the threshold amounts shown in the table. In its newest Value of Volunteer Time report Independent Sector with the Do Good Institute announced on April 18 2022 that the latest value of a volunteer hour is estimated to be 2995 which is a 49 increase from 2020 to 2021. First she should take her 150K salary and divide that by the number of hours she plans to work in the year.

She wants to figure out what her equivalent hourly rate would be as a contractor. Employment History Information on all employers you worked for during the past 18 months including name address mailing and physical location the dates of employment gross wages earned hours worked per week hourly rate of pay and. The hourly paid computer professional exemption will change on July 1 2020.

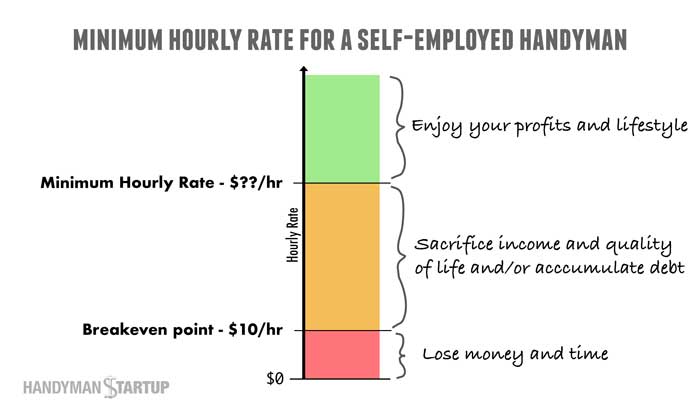

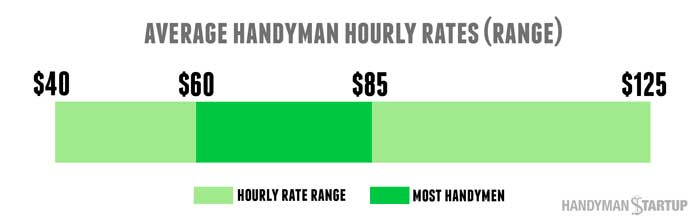

How much does it cost to. So lets say you need to make 5000month to live expect your business expenses to be about. Hourly rates for contractors range from 50 to 150.

So get a decent playlist created and start delivering. A 5050 split for an independent contractor is a pretty low percentage to the clinician. Take your hourly rate and multiply it by 2080 which is the number of hours in.

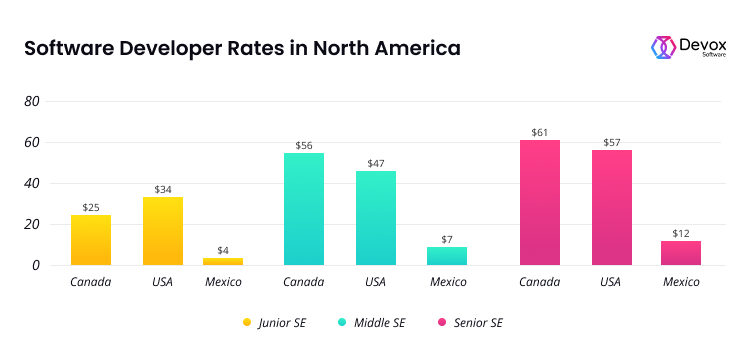

How to calculate the hourly rate differences between W-2 and 1099 workers. If you are self-employed or an independent contractor you will need your net income total after taxes. If you dont want the download the free rate calculator above the math goes like this.

The Economics Daily Consumer Price Index unchanged over the month up 85 percent over the year in July 2022. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses. But wait it doesnt end there Step 6.

This will rise to 4725hour plus CPI adjustments for all employers by 2022 after which annual CPI adjustments will be applied. W-2 Pay Difference Calculator for Salary and Benefits. Companies are always looking to hire home delivery box truck or independent contractor drivers.

When breaking down the differences between 1099 and W-2 there are other considerations to keep in mind such as hourly rates salaries and benefits. Any workers who do not satisfy all three conditions laid out in the ABC test must be classified as employees for California employment law purposes even if that worker would still qualify as an independent. More common is 60 to 70 yo the independent contractor.

Free paystub maker tool is specially designed to generate printable pay stubs in PDF format at your Email for easy download share online without repaying. As an independent contractor youll have to pay 2 or 3 taxes depending on where you live. General Contractor Hourly Rates.

W-2 hourly rate difference is rarely so simple when an employees annual salary and benefits package are also factors. Heres how I do that. Employment and Wages Data Viewer.

There are 40 hours per week and 52 weeks per year so a full year with no time off would have 4052 2080 hours. Seeing as how more and more things are being purchased online this probably wont be going anywhere. Of course knowing the 1099 vs.

52 x 8 416. A 1099 contractor making 35hour would then expect to make about 3250hour 3510765. Learn more about these calculations below.

Regions States Areas at a Glance. Try Free Pay Stub creator to generate paystubs without Watermarks online include all company employee income tax deduction details. Economy at a Glance.

Now you have your rates. Contract-Awarded Labor Category CALC tools let federal contracting officers and others find awarded prices for negotiations for labor contracts. 09 on top of the regular Medicare tax rate.

Can I charge for taxes using the invoice app. I am working on a survey to collect real data on your question. If a general contractor agrees to work on an hourly rate theyll likely require the customer to commit to a minimum.

Do some market research. Not to mention being an Uber Eats or Postmates driver. If youre paid hourly as a contractor you may need to convert that hourly pay into a salary so you can compare to a full-time salary.

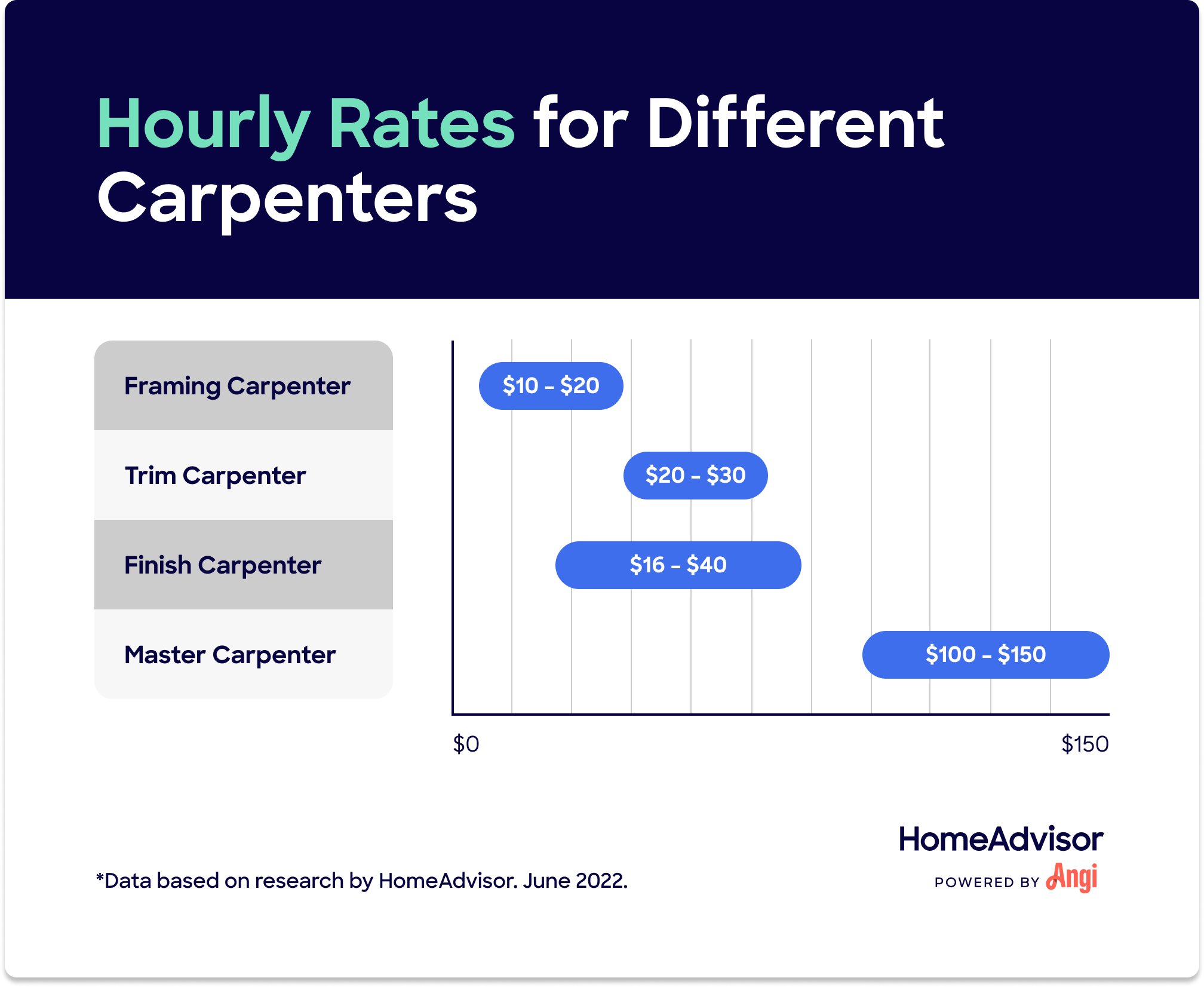

Most cleaning jobs should take 15 to 3 hours and your rates will vary from 25 to 50 an hour for most independent contracts. Injury and Illness Calculator.

What Are Average Carpenter Hourly Rates

How Much Do Software Developers Make Per Hour Devox Software

Hourly Rate Hr Invoice Template

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

Labor Rate Calculator Servicetitan

Hourly Rate Hr Invoice Template

Hourly Invoice Template Download And Customize Invoice2go

Employee Cost Calculator Updated 2022 Employee Cost Calculation

Calculate Your Hourly Rate As A Contractor Download Hourly Rate Calculator

How To Invoice For Hourly Work

![]()

Daily Rate Hourly Rate Or Agree On A Fixed Price

Ultimate Guide For Billable Hourly Rates Management In 2022

Hourly Rate Hr Invoice Template

What S Your Time Worth How To Determine Your Hourly Rate

What S Your Time Worth How To Determine Your Hourly Rate

2022 Handyman Hourly Rates Price List Avg Job Cost

Determining Hourly Rates For A Contractor Or Small Business Driveyoursucce